2TouchPOS Working for you to keep your money SAFE!

Keeping

track of your charge payments and payment processes is becoming routine for business

owners. Monitoring your bank account

balances is a daunting task, but now that consumers have the ability to dispute

charges; more and more businesses are left “Holding the Bag”. Chargebacks can happen when a customer claims

that they did not get what they paid for.

A consumer can get their money back after a purchase simply by calling

their bank or a Credit Card Dispute

Agency; explaining the circumstance and then if the bank agrees or finds

cause, the money is given back to the consumer.

This means that YOUR customers may have the ability to reverse a charge

for a tab that you thought was paid for. I was reading some articles on the topic as I

continue to be concerned for our 2TouchPOS customers. Take a look: Chargeback

Article.

Keeping

track of your charge payments and payment processes is becoming routine for business

owners. Monitoring your bank account

balances is a daunting task, but now that consumers have the ability to dispute

charges; more and more businesses are left “Holding the Bag”. Chargebacks can happen when a customer claims

that they did not get what they paid for.

A consumer can get their money back after a purchase simply by calling

their bank or a Credit Card Dispute

Agency; explaining the circumstance and then if the bank agrees or finds

cause, the money is given back to the consumer.

This means that YOUR customers may have the ability to reverse a charge

for a tab that you thought was paid for. I was reading some articles on the topic as I

continue to be concerned for our 2TouchPOS customers. Take a look: Chargeback

Article.

This concept is beginning to really hit establishment

owners in the restaurant industry. I’ve

been concerned for our customers since the EMV

Chip Card Technology was rolled out, as the dispute process has been made simpler

for consumers. Don’t get me wrong; there

are some situations where a chargeback is warranted, however it is becoming common

practice. This process of returning

money to the consumers after they have spent an evening in your establishment

weighs heavily on the owner or merchant who is now responsible for ensuring

that guests always get what they pay for or; they will end up responsible.

This concept is beginning to really hit establishment

owners in the restaurant industry. I’ve

been concerned for our customers since the EMV

Chip Card Technology was rolled out, as the dispute process has been made simpler

for consumers. Don’t get me wrong; there

are some situations where a chargeback is warranted, however it is becoming common

practice. This process of returning

money to the consumers after they have spent an evening in your establishment

weighs heavily on the owner or merchant who is now responsible for ensuring

that guests always get what they pay for or; they will end up responsible.

Chargebacks are becoming big

business and I am sure that this trend is not going away. At 2TouchPOS we have been working diligently

to ensure that our recommended payment processing company has prioritized

shifting liability through their fraud prevention practices. Payment

Processing Companies act as the middlemen between banks, merchants and the

consumer. As middlemen your payment

processing company is partly responsible for collecting funds from the

consumer. With the right payment

processor your liability becomes a shared responsibility.

Sometimes we get a call from a prospective customer

who wants to save money using a payment processor that has not been fully

reviewed through the 2TouchPOS Process.

In the long run we want to please our customers and we do what we can to

help our customers get what they need to make payment processing affordable and

to keep our customers safe from fraud.

So we have suggestions that

may assist our customers and our future customers! Right now in the restaurant

industry there is a BIG PUSH to create a customer experience. To ensure the

customer gets what they pay for make sure that there is consistency in the

preparation of your menu items, drinks and most importantly service. Now more

than ever, YOUR Front of the House Staff HAS to be “ON-POINT”! If you

have entertainment they must start on time, and play as long as you have

advertised.

So we have suggestions that

may assist our customers and our future customers! Right now in the restaurant

industry there is a BIG PUSH to create a customer experience. To ensure the

customer gets what they pay for make sure that there is consistency in the

preparation of your menu items, drinks and most importantly service. Now more

than ever, YOUR Front of the House Staff HAS to be “ON-POINT”! If you

have entertainment they must start on time, and play as long as you have

advertised.

In the meantime watch your

accounts, if a dispute is initiated tell your side of the story, and work with your payment processor to avoid

chargebacks.

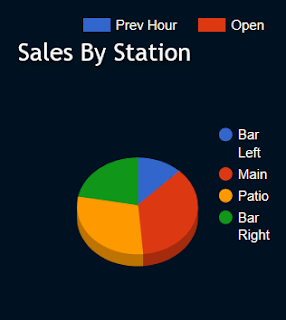

Push yourself to follow your

sales history; monitor your credit card activities, keep an eye on your

transaction history, and manage your business by making sure the ‘Right Staff’

have your back. Watch your profits increase through sound business practices

and never ‘over promise’. If you need any assistance with your reports or are

having trouble finding information that you need, let us know. We can help. Contact us!

http://www.2touchpos.com/Company/ContactUs.aspx

Comments

Post a Comment